japan corporate tax rate pwc

Controlled foreign company CFC to which an applicable tax rate is 30 in case of a shell company or 20 are included in the. The rate of special local corporate tax is 81.

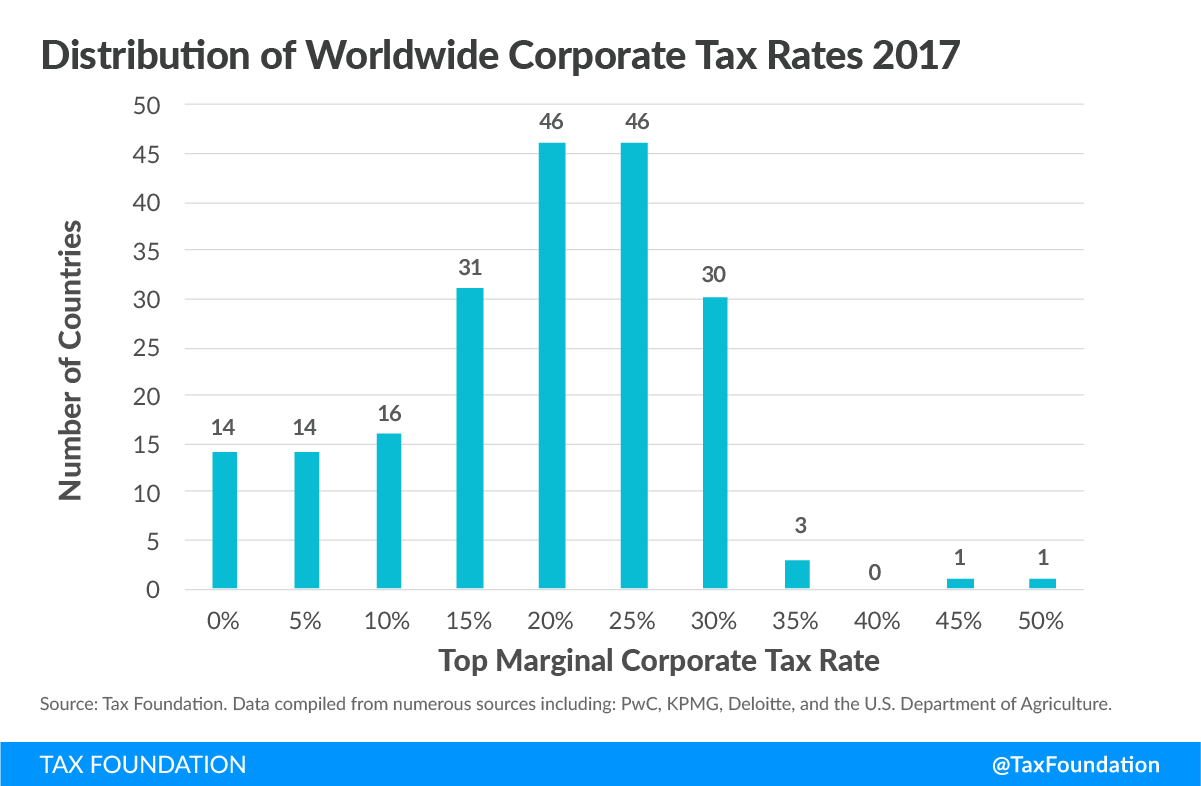

Corporate Tax Rates Around The World Tax Foundation

Japanese Consumption Tax.

. This useful online tool will help you make informed decisions with the most up-to-date and relevant details about tax systems in. This provision imposes a 15 minimum tax on adjusted financial statement income AFSI for corporations with average annual AFSI over a three-tax year period in excess of 1 billion. Headline individual capital gains tax rate Gains arising from sale of stock are taxed at a total rate of 20315 15315 for national tax purposes and 5 local tax.

An additional 3 tax will be levied from FY22 to FY25 on financial institutions with taxable income equal to or greater than 120000 tax units Unidad de Valor Tributario - UVT resulting in a new. We are pleased to be gold level sponsors for the Sailpoint Navigate 2022 conference an exclusive event that aims at gathering the best thinkers and practitioners of Identity. The Japanese government introduced a new Qualified Invoice.

These challenges have become increasingly complex for companies of all sizes. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are. 15 or 22 applicable surcharge and cess subject to certain conditions.

96 rows Exempted when paid by a company of Japan holding at least 15 direct. PwCs International Tax Service group comprised of professionals who have worked internationally with PwC member firms as well as those who are seconded from overseas PwC. The Corporate Tax Rate in Japan stands at 3062 percent.

2022 corporate tax rates in Switzerland 6. Our clients face a wide variety of tax challenges across their businesses. Pursuant to the amendments of Article 5 of the Organisation for Economic Co-operation and Development OECD Model Tax Treaty OECD MTC in November 2017 and the.

Preparing for new Qualified Invoicing Issuer Rules effective from October 1 2023. A variety of strategies have been identified developed implemented by our inbound tax planning services group to meet the business needs of the foreign multinational while maintaining a. United States of America 40.

Worldwide Tax Summaries cuts through those complexities. Corporate Tax Rate in Japan averaged 4049 percent from 1993 until 2022 reaching an all time high of 5240 percent in 1994 and a. A combination of changes published in the latest Japanese tax reform on 8 December 2016 and the upcoming decrease in UK corporate tax rate to 19 could mean the Japanese Controlled.

A combination of changes published in the latest Japanese tax reform on 8 December 2016 and the upcoming decrease in UK corporate tax rate to 19 could mean the Japanese Controlled. Business Tax and Special Local Corporate Tax Business tax imposed on an electrical power supplier is based on its revenue instead of profit. India 2800 3400 2500 3000 3300 2500.

Undistributed profits of a foreign subsidiary ie.

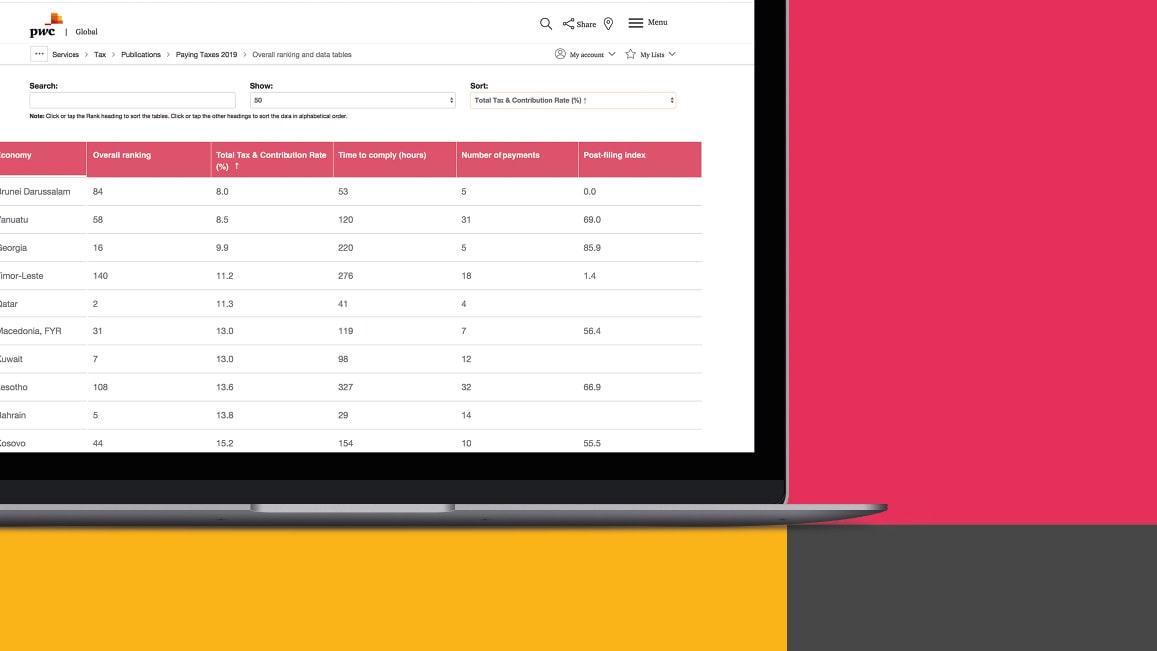

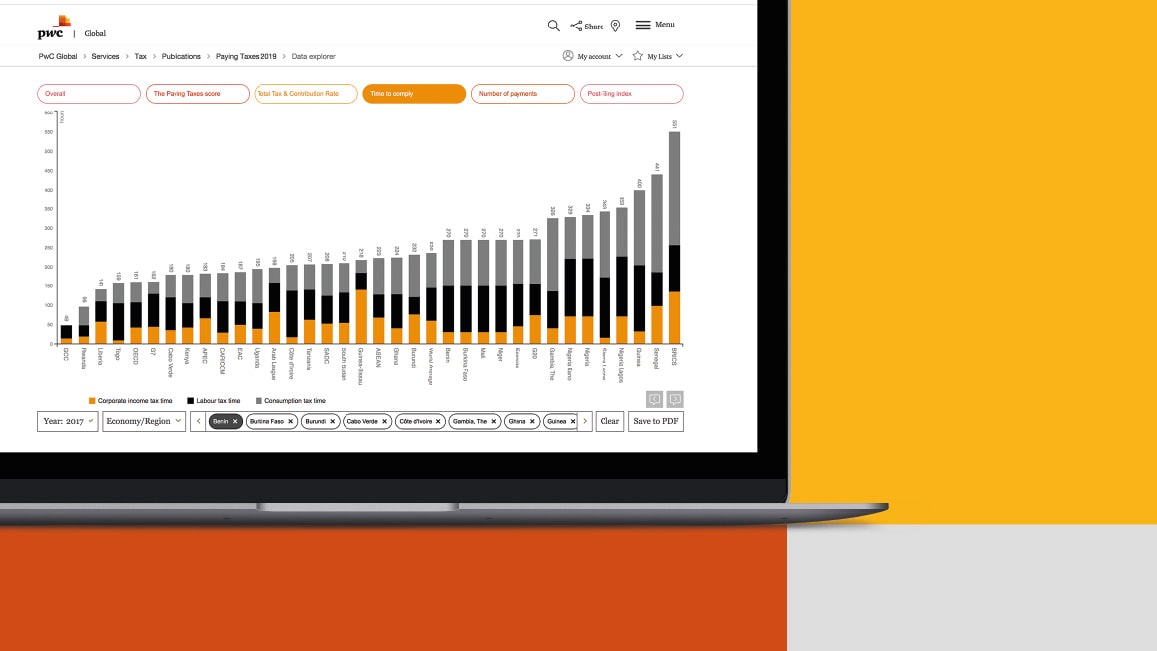

Paying Taxes 2020 In Depth Analysis On Tax Systems In 190 Economies Pwc

Pwc Audit And Assurance Consulting And Tax Services

Tax Reporting Strategy Tax Services Pwc

List Of Countries By Tax Rates Wikipedia

Poland Significant Corporate Tax Changes Arriving In 2022 Pwc

Corporate Tax Rates By Country Corporate Tax Trends Tax Foundation

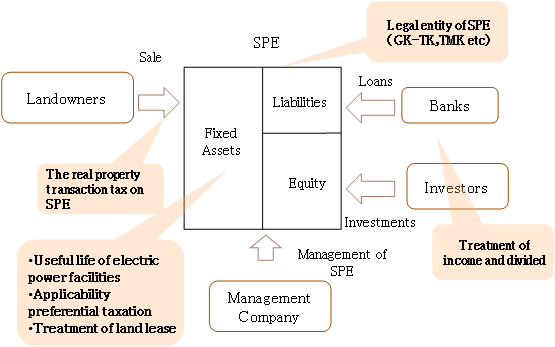

Tax Issues On Operation And Investments In Renewable Energy Business Pwc Japan Pwc Japan Group

Corporate Tax Rates Around The World Tax Foundation

Pricewaterhousecoopers Wikipedia

2022 Korean Tax Summaries Samilpwc